NEWS & EVENTS

Thailand’s office market continues to face significant challenges due to the increasing supply of office space. The ongoing trend of hybrid work and work-from-home, which has persisted since the COVID-19 pandemic, has led to a decline in demand for office space. Many companies downsized their offices and shifted towards coworking spaces or short-term office rentals. There is also a growing trend on flexibility in office usage, such as implementing hot-desking arrangements where employees do not have fixed workstations.

Demand for traditional office spaces is declining due to rising rents and many companies opting for smaller spaces. Offices in the Mixed-use development projects, along with Smart Offices, are gaining traction and attracting tenants. The growth of co-working spaces and flexible offices is expanding to cater the demands from startups and mid-sized businesses. Economic situations and rising real estate costs are driving companies to seek more cost-effective alternatives.

Investment in green office buildings is on the rise as tenants increasingly prioritize ESG (Environmental, Social, and Governance) and sustainability framework. Older office buildings without certifications or sustainability plans must adapt to meet the changing tenant demands and preferences. Environmentally friendly offices with certifications such as TGBI, LEED, and WELL are gaining greater interest. Thus, Grade A offices and coworking spaces with advanced technology, clean air systems, and wellness-focused amenities that support modern employee lifestyles are becoming increasingly popular.

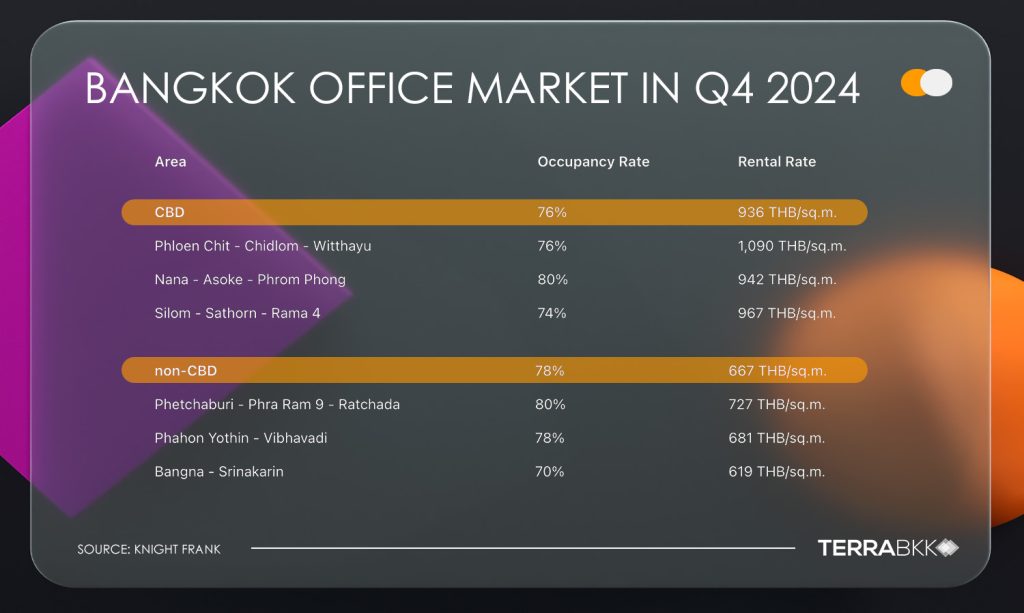

- For the office market, data from Knight Frank reported Bangkok’s office market in Q4 2024:

- CBD Area: Rental prices slightly increased, with the average rent rose 0.1% (QoQ) to 963 THB/sq.m./month. Occupancy rate improved to 76%, up 0.7% (QoQ).

- Ploenchit–Chidlom–Witthayu areas: Rental prices remained unchanged at 1,090 THB/sq.m., while occupancy rate increased by 0.2% (QoQ) to 76%.

- Nana–Asoke–Phrom Phong areas: Rental prices rose 0.4% (QoQ) to 942 THB/sq.m., with occupancy increased slightly by 1.0% (QoQ) to 80%.

- Silom–Sathorn–Rama 4 areas: Rental prices slightly declined by 0.2% (QoQ) to 967 THB/sq.m., but occupancy improved 1.0% (QoQ) to 74%.

- In non-CBD areas, rental prices slightly increased, with the average rent rose 0.1% (QoQ) to 667 THB/sq.m./month. Occupancy rate improved to 78%, up 0.8% (QoQ).

- Phetchaburi–Rama 9–Ratchada areas: Occupancy rate remained at 80%, with rental prices rose by 0.7% (QoQ) to 727 THB/sq.m.

- Phahonyothin–Vibhavadi: Rental prices declined 0.5% (QoQ) to 681 THB/sq.m., while occupancy rate increased 2.6% (QoQ) to 78%.

- Bangna–Srinakarin: Occupancy rose 1.2% (QoQ) to 70%, while rental prices slightly increased by 0.2% (QoQ) to 619 THB/sq.m.